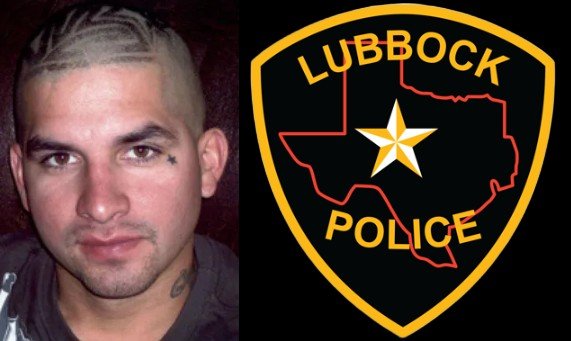

Lubbock Man Sentenced to 15 Years in Prison for $4 Million PPP Fraud

A Lubbock man who defrauded pandemic-era financial programs out nearly $4 million was sentenced today to 15 years in federal prison, announced U.S. Attorney for the Northern District of Texas Leigha Simonton.

Andrew Travis Johnson, 59, pleaded guilty in March to three counts of bank fraud, one count of aggravated identity theft, and one count of engaging in monetary transactions in property derived from unlawful activity. He was sentenced Thursday by U.S. District Judge James Wesley Hendrix, who ordered him to pay $4.15 million in restitution and to forfeit numerous assets, including multiple luxury cars.

According to plea papers, Mr. Johnson admitted that he fraudulently applied for and obtained 27 Paycheck Protection Program (PPP) loans totaling almost $4 million.

He admitted he applied for loans on behalf of three entities: an actual business that provided contract speech and occupational therapy services, an actual nonprofit that organized community fundraisers for individuals with intellectual limitations, and a fictitious entity that never provided goods or services of any kind and had no employees.

In the business’s application, Mr. Johnson falsely claimed the company paid 49 employees an average of $441,667 per month and provided a fabricated IRS Form 940 that indicated it paid its employees more than $5.1 million in calendar year 2019. In actuality, the company employed about 10 individuals on an ad hoc basis and paid less than $100,000 in wages in 2019. Nevertheless, based on his application, the business qualified for a $1.1 million PPP loan, which it re-drew the following year, for a total of $2.2 million.

In the nonprofit’s application, he falsely claimed the organization employed 33 individuals (in actuality, it employed fewer than five), and in the application submitted on behalf of the fictitious entity, he falsely claimed the company employed 24 individuals (in actuality, the company did not exist). For each entity, he provided fabricated lists of employees, some of which did not exist and others of which were clients of the rehabilitation company, along with fabricated IRS forms. Nevertheless, he qualified for a $326,770 loan for the entity and a $523,00 loan for the nonprofit. He redrew a loan for the non-existent entity the following year for a total of $653,540.

Each entity sought – and received – forgiveness on the principal and interest on each of the small business PPP loans. Yet very little, if any, of the money was used for payroll or business expenses. Instead, Mr. Johnson and a woman with whom he had a relationship, 50-year-old Hope Leticia Hastey, spent nearly $3.5 million on home renovations, vacations, clothing, cosmetic surgery, college tuition, cars, wedding expenses, and equipment for an unrelated business venture.

In addition to the small business loans, Mr. Johnson also fraudulently obtained $436,524.80 in first and second draw loans for 11 purported independent contractors, several of whom were related to him or Ms. Hastey.

At least four of the recipients were unaware that Mr. Johnson had used their identifying information to obtain the loans, nor did they ever receive any proceeds of the loans. Mr. Johnson opened bank accounts under the victim’s names, transferred to loan proceeds into the accounts, and obtained debit cards for each account; he and Ms. Hastey used the debit cards to spend the loan monies.

Mr. Johnsons and others sought – and received – forgiveness on the principal and interest on each of the independent contractor loans, which ranged from roughly $15,000 to nearly $24,000 each.

At Thursday’s sentencing hearing, prosecutors said that he used his elderly mother’s and elderly aunt’s identifying information and forged their signatures on loan documents. The women never received any of the money. Mr. Johnson also used the identifying information and forged the signature of L.G., a resident of Plainview, to obtain two loans.

Ms. Hastey has been charged with misprison (concealment) of Mr. Johnson’s felonies and is set to enter a plea on Aug. 30. She remains innocent until proven guilty in a court of law.

The Federal Bureau of Investigation’s Dallas Field Office and IRS – Criminal Investigations conducted the investigation with the assistance of the Internal Revenue Service and Homeland Security Investigations. Assistant U.S. Attorneys Ann Howey prosecuted the case with assistance from Assistant U.S. Attorneys Beverly Chapman, Saurabh Sharad, and John de la Garza.

The Paycheck Protection Program (PPP) was authorized under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a federal law enacted on March 29, 2020, to provide emergency financial assistance to Americans suffering economic hardship due to the COVID-19 pandemic. The PPP provided forgivable loans to small businesses to cover payroll, rent, and other certain business expenses; the program ended in May 2021.

Concerned citizens who suspect waste, fraud, or abuse of financial-era pandemic programs, including the PPP, or who suspect violations of pandemic-related legislation can report it to the Pandemic Response Accountability Committee (PRAC) at https://www.pandemicoversight.gov/contact/about-hotline.